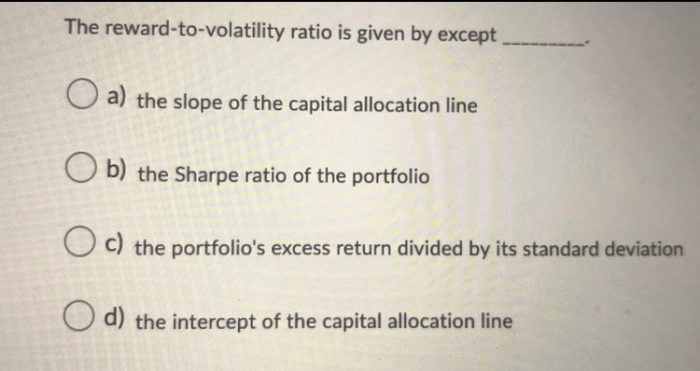

The reward-to-volatility ratio is given by __________. – The reward-to-volatility ratio is given by __________, a crucial metric in investment analysis that quantifies the potential return an investment can yield relative to its risk. This ratio serves as a valuable tool for investors seeking to make informed decisions and optimize their portfolios.

By understanding the factors that influence the reward-to-volatility ratio and its applications, investors can effectively manage risk and enhance their investment strategies.

Definition of Reward-to-Volatility Ratio

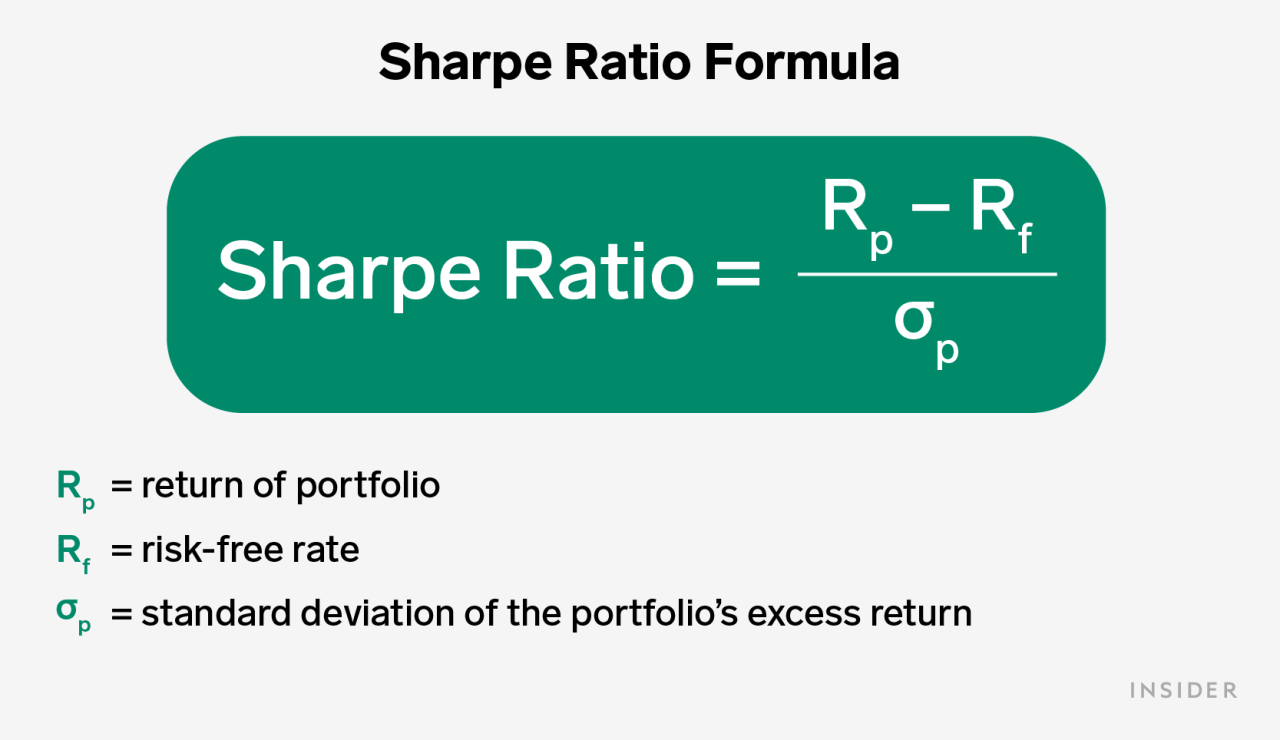

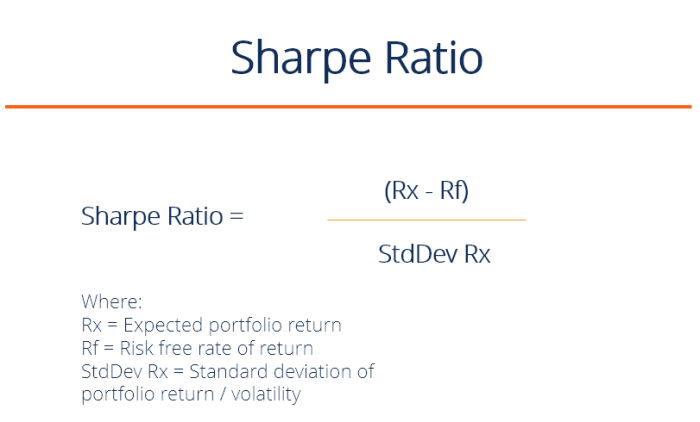

The reward-to-volatility ratio quantifies the relationship between the potential return and the level of risk associated with an investment.

It is calculated as the ratio of the expected return to the standard deviation of returns.

Expected return

Standard deviation of returns

A higher reward-to-volatility ratio indicates that the investment has a higher potential return for a given level of risk.

Helpful Answers: The Reward-to-volatility Ratio Is Given By __________.

What is the formula for calculating the reward-to-volatility ratio?

The reward-to-volatility ratio is calculated as the ratio of the expected return of an investment to the standard deviation of its returns.

How can I use the reward-to-volatility ratio to compare different investments?

By comparing the reward-to-volatility ratios of different investments, investors can assess their relative risk and return profiles and make informed decisions about which investments to include in their portfolios.

What are the limitations of using the reward-to-volatility ratio?

The reward-to-volatility ratio does not consider all aspects of investment risk, such as correlation with other assets and potential for extreme losses. It should be used in conjunction with other risk assessment tools.