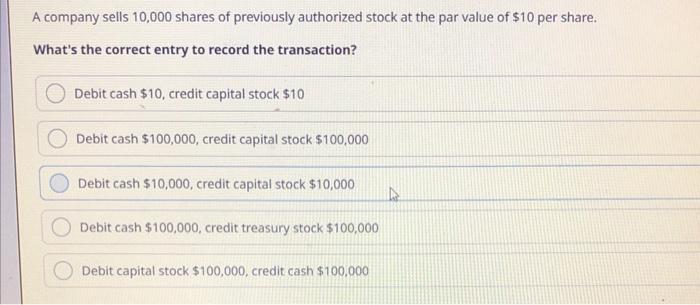

A company sells 10000 shares of previously – When a company sells 10,000 shares of previously issued stock, it can have a significant impact on shareholders, financial implications, market considerations, legal and regulatory aspects, and communication and transparency. This article delves into these key areas to provide a comprehensive understanding of the implications of such a sale.

The sale of shares can affect shareholder equity, ownership percentages, voting rights, and dividend distributions. It can also impact the company’s cash flow, balance sheet, and funding for corporate initiatives.

Shareholder Impact

When a company sells 10,000 shares of previously issued stock, it can have a significant impact on shareholders. The sale of shares can dilute shareholder equity and ownership percentages, which can affect voting rights and dividend distributions.

Shareholder Equity and Ownership Percentages

The sale of shares increases the number of outstanding shares, which dilutes the ownership percentage of existing shareholders. This means that each share represents a smaller portion of the company’s total equity.

Voting Rights and Dividend Distributions

The sale of shares can also affect shareholder voting rights and dividend distributions. If the new shares have voting rights, they will dilute the voting power of existing shareholders. Similarly, if the new shares are entitled to dividends, they will reduce the dividend per share received by existing shareholders.

Financial Implications

The sale of 10,000 shares of previously issued stock can have significant financial implications for the company. The proceeds from the sale can be used to fund various corporate initiatives, such as expansion, acquisitions, or debt reduction.

Cash Flow and Balance Sheet

The sale of shares increases the company’s cash flow and strengthens its balance sheet. The proceeds from the sale can be used to improve the company’s financial position and invest in future growth.

Funding Corporate Initiatives

The proceeds from the sale of shares can be used to fund a variety of corporate initiatives. This can include investments in new products or services, acquisitions, or debt reduction.

Market Considerations

The sale of 10,000 shares of previously issued stock can have a significant impact on the company’s stock price and market capitalization. The sale of shares can affect investor sentiment and the company’s overall valuation.

Stock Price and Market Capitalization

The sale of shares can dilute the company’s stock price, as the number of outstanding shares increases. This can lead to a decrease in the company’s market capitalization, which is the total value of all outstanding shares.

Investor Sentiment and Company Valuation

The sale of shares can also affect investor sentiment and the company’s overall valuation. If investors perceive the sale of shares as a sign of weakness or financial distress, it can lead to a decline in the stock price and a decrease in the company’s valuation.

Legal and Regulatory Aspects

The sale of 10,000 shares of previously issued stock involves a number of legal and regulatory considerations. The company must comply with all applicable disclosure requirements and regulatory filings.

Disclosure Requirements and Regulatory Filings

The company must disclose the sale of shares in a timely manner to the relevant regulatory authorities. This includes filing a Form 8-K with the Securities and Exchange Commission (SEC) within four business days of the sale.

Legal and Compliance Risks

The sale of shares can also involve a number of legal and compliance risks. The company must ensure that it complies with all applicable laws and regulations, including insider trading laws and anti-fraud provisions.

Communication and Transparency: A Company Sells 10000 Shares Of Previously

Effective communication and transparency are essential when a company sells 10,000 shares of previously issued stock. The company should clearly communicate the reasons for the sale and the potential impact on stakeholders.

Communicating with Shareholders and Investors, A company sells 10000 shares of previously

The company should communicate the sale of shares to shareholders and investors in a timely and transparent manner. This can be done through press releases, investor presentations, and other communication channels.

Best Practices for Communication

Best practices for communicating with shareholders and investors include providing clear and concise information, being responsive to inquiries, and addressing any concerns or questions in a timely and professional manner.

FAQs

What are the potential legal risks associated with the sale of shares?

Potential legal risks include disclosure violations, insider trading, and non-compliance with regulatory requirements.

How can companies communicate effectively about the sale of shares?

Companies can use press releases, investor presentations, and direct communication with shareholders to explain the reasons for the sale and its potential impact.